|

服务热线:400-820-2536 |

|

服务热线:400-820-2536 |

深度分析反避税最近动态及关联交易风险应对(广州)

2014年以来,国际反避税态势日趋严峻,而国内爆发出大量类似向境外关联方支付不合理费用而遭遇税务机关反避税调整的案例,当然也有更多的企业逃避了税务机关的“法眼“,通过此举实现了境内利润的转移。因此,我国的反避税形势也是持续发酵,各地税务机关厉兵秣马,积极的开展国际税收(反避税)专题业务培训。2014年年中前后,国税总局连续发布了几个与反避税相关的重磅文件,如股息红利非居民税收专项检查,对外大额支付费用(服务费及特许权使用费)反避税钓鱼城及《一般反避税管理办法》等等,2015年一开年,总局又在反避税领域相继投放了两枚重磅炸弹,既16号公告以及7号公告。面对我国高压的反避税态势,企业应该如何从容应对?F—council希望通过本次活动和会员们一起交流分享最新的反避税政策及专家的相关应对建议,帮助企业切实规避税务风险。

本期价值要点:

l 当前我国反避税最新形势分析(146号文与16号公告背后的意义)

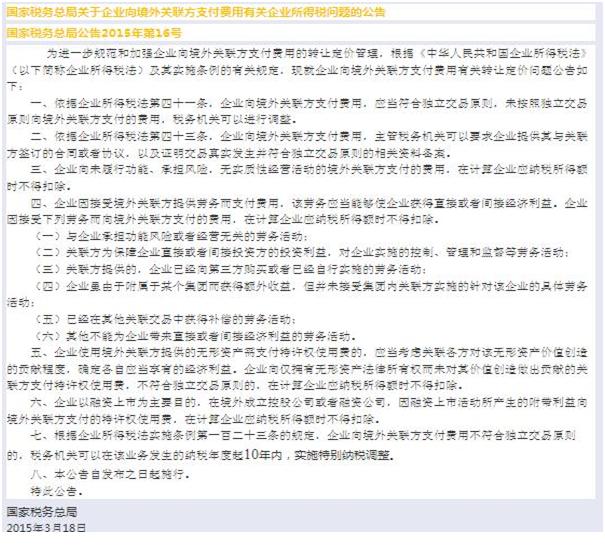

l 深度分享《关于企业向境外关联方支付费用有关企业所得税问题的公告》(国家税务总局2015年16号公告)解析及建议

l 实例解析——非贸付汇及转让定价风险的规避

同行困惑:

l (特许权使用费的认定)A公司与美国X大学签订协议,选派一批业务骨干去该大学参加为期两周的业务培训,合同总金额为15万美元。A公司在进行对外支付税务备案时,有人认为应将其认定为特许权使用费,并代扣代缴美国X大学6%的增值税和10%的预提所得税。请问这真的包含特许权使用费吗?

l (独立交易原则)两个独立法人的母子公司之间提供管理、服务所发生的费用,在计缴企业所得税时如何处理?

活动特邀分享嘉宾

EY 转让定价 合伙人

企业观察员

迈锐恩精密元器件(深圳)有限公司 财务经理 Winne

西屋月台屏蔽门(广州)有限公司 王经理

吉田拉链 王经理

东京海上日动火灾保险(中国)有限公司 财务 李小姐

流程安排

13:30-14:30当前我国反避税总体形式分析(146号文及16号公告发布背景)

l 2014年度我国反避税重磅文件介绍

l 2015反避税的重点领域

l 加大对位于避税地和低税地关联企业支付大额费用的反避税力度

14:30-14:45 茶歇

14:45-15:45 深度解读《关于企业向境外关联方支付费用有关企业所得税问题的公告》(2015年16号公告)

l 独立交易原则分析

——根据企业所得税法实施条例第一百二十三条的规定,企业向境外关联方支付费用不符合独立交易原则的,税务机关可以在该业务发生的纳税年度起10年内,实施特别纳税调整。

l 何谓真实性检查

——依据企业所得税法第四十三条,企业向境外关联方支付费用,主管税务机关可以要求企业提供其与关联方签订的合同或者协议,以及证明交易真实发生并符合独立交易原则的相关资料备案。

l 功能风险分析

——企业向未履行功能、承担风险,无实质性经营活动的境外关联方支付的费用,在计算企业应纳税所得额时不得扣除

l 受益性测试

——测试企业接受的劳务是否能够为其带来直接或间接经济利益。一旦发现企业接受关联方提供的非受益性劳务而支付的费用,则在计算企业应纳税所得额时不得允许其扣除。

l 贡献度测试

——企业使用境外关联方提供的无形资产需支付特许权使用费的,应当考虑关联各方对该无形资产价值创造的贡献程度,确定各自应当享有的经济利益。

15:45-16:45实例解析——非贸付汇及转让定价风险的规避

l 服务费/劳务费/特许权使用费对外支付

l 代垫款项对外支付

l 合同条款设置,合同备案环节企业常见问题

…

16:45-17:15 互动问答

17:15 活动结束

Back Ground

Since 2014, the international anti-avoidance trend has become increasingly serious, which broke out in a large number of domestic similar pay unreasonable fee to the overseas related parties with the tax authority for the adjustment of the anti tax avoidance cases, of course, there are more and more enterprises to avoid the tax authorities "eyes", through which implements in the transfer of profits. Therefore, our country's tax situation is also a continuous fermentation, making local tax authority, actively carry out international tax anti-avoidance) project business training. Before and after the mid - 2014, national tax administration of continuous issued a few big files related to anti tax avoidance, such as dividends non-resident tax special inspection, foreign big pay fees (fees and royalties) and anti-avoidance fishing city management and so on, the general anti-avoidance YiKai in 2015 years, administration and in the field of anti-avoidance successively launched two bombshell, announcement of announcement is 16 and no. 7. In the face of the high pressure of anti-avoidance, enterprise should be how to cope? F - Council members hope that through this activity, and sharing together the latest anti tax policy and the related Suggestions to cope with the situation, experts to help enterprises to avoid tax risk.

Key Points

l Latest situation analysis current our country's tax (no. 146 and 16, the meaning behind the

announcement)

l Share the depth to the relevant overseas affiliated party pay enterprise income tax about the

enterprise problems of announcement of announcement (the state administration of taxation in 2015

16th) analysis and suggestion

l Instance analysis - the trade payment and transfer pricing risk aversion

Peer Confuse

l(the cognizance of royalties) A company signed an agreement with the University of X, select A group of

business elites to the university to attend A two-week business training, contract amount is $150000. In A

company for foreign pay tax for the record, some people think that should be considered royalty, and

withholding of the University X 6% VAT and 6% withholding income tax. Is it really contains a royalty?

l (Principle) of two independent legal fee between mother and child company providing management

and service, pay enterprise income tax when the meter?

Speaker

EY TP Parnter

Agenda

13:30-14:30 The current overall formal analysis of China's anti-avoidance (announcement no. 146 and the 16th background)

l 2014 our anti-avoidance blockbuster file is introduced

l 2015 anti tax avoidance in key areas

l Increase in tax havens and low tax anti-avoidance associated enterprises pay for big cost

14:30-14:45 Tea Break

14:45-15:45 Interpretation on the enterprise to overseas related parties pay announcement on the problem of enterprise income tax (16 announcements, 2015)

l Principle analysis

- according to the enterprise income tax law implementation regulations, the provisions of article one hundred and twenty-three of the companies to pay overseas related parties does not comply with the principle, the taxation authority may occur in the business tax year within 10 years, the implementation of special tax adjustments.

l What is a reality check

- according to article 43 of the emit law, the enterprise to overseas related parties to pay fees, the competent tax authorities may require companies to provide the signing of the contract or agreement with related parties, and demonstrate a real and in line with the principle of the related data for the record.

l Risk analysis of functional

- enterprise fails to fulfill its function, take a risk, there is no substantial business activities of the overseas related parties to pay cost, when calculating the enterprise the taxable income amount shall not be deducted

l Benefited from the test

- Test enterprise can accept labor for its economic benefits directly or indirectly. Once found enterprise accepts non benefits provided by the labor and associated fees, in computation of taxable income shall not allow its deduction.

l Contribution to the test

- enterprise use intangible assets should be provided by the overseas related parties to pay royalties, should consider the associated parties to value creation contribution degree of the intangible assets, determine their economic interests should enjoy.

15:45-16:45 Instance analysis - the trade payment and transfer pricing risk aversion

l Service charge/labor/foreign pay royalties

l Foreign payment item generation advances

l The terms of the contract set up, registration link enterprise common problems

…

16:45-17:15 Q&A

17:15 End

相关法规文件

1. 《关于做好组织税收收入工作的通知》(税总发[2014]78号)解析

2. 《关于居民企业报告境外投资和所得信息有关问题的公告》(国家税务总局公告2014年第38号)深度解析及建议

3. 《关于开展股息、红利非居民税收专题检查工作通知》(税总函[2014]317号)解析及建议

4. 《关于对外支付大额费用反避税调查的通知》(税总办发[2014]146号)深度解析及案例分析

5. 《关于特别纳税调整监控管理有关问题的公告》(国家税务总局公告2014年第54号)深度解析及建议

6. 《一般反避税管理办法(试行)》(国家税务总局令第32号)解析及建议

7. 《关于非居民企业间接转让财产企业所得税若干问题的公告》(国家税务总局公告2015年第7号)解析及建议

8. 《关于企业向境外关联方支付费用有关企业所得税问题的公告》(国家税务总局2015年16号公告)解析及建议

F-Council近期举办过的“反避税”相关活动回顾

| 客服专线:400 820 2536 | 咨询专线:400 820 2536 |

| 咨询邮箱: | 解答邮箱:cs@fcouncil.com |

银行名称:招商银行股份有限公司

开户行:招商银行股份有限公司上海虹桥支行

帐户:121908638710202

|

Copyright © 2008-2024 协同共享企业服务(上海)股份有限公司版权所有 China Finance Executive Council (F-Council)为协同共享企业服务(上海)股份有限公司旗下服务品牌 网站备案/许可证号:沪ICP备15031503号-1 |

FCouncil |

御财府 |

||||